eBay has recently announced that it will be managing payments on its platform, the news has come with a lot of questions and doubts. This article is a comprehensive guide on what you should know about eBay managed payments. We discuss:

- What is eBay managed payments ?

- Benefits of managed payments

- Problems with managed payments

- Is eBay managed payments mandatory ?

- Ebay Managed Payments fees

- Ebay Managed Payments processing time

What is eBay Managed Payments ?

If you have been an eBay seller for a long time you’ll know how closely integrated Paypal has always been with eBay. Over the years PayPal has provided its robust expertise in online payments to facilitate transactions on eBay, but eBay managed payments looks to change this completely by taking control of the job of managing transactions. While it may seem sudden to sellers that do not follow the moves of the company, this is actually something that has been in the works for several years and started out as an invite only program.

The old “Paypal” system: A buyer purchases from you on eBay > Money shows up in your PayPal balance > You can typically transfer it to your bank account instantly (Or use it directly from your paypal balance)

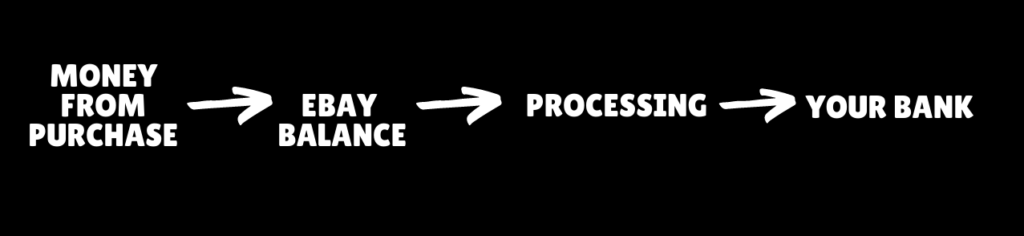

The new “Managed Payments” system: A buyer purchases from you on eBay > Money shows up in your eBay balance > Money has a processing/clearing period > You can typically transfer it to your bank account.

Instead of your earnings getting moved to paypal you will now be able to see them on the platform and also handle many operational tasks related to your earnings directly on the platform. These operational tasks can include things such as issuing refunds.

Benefits

So far, you’re probably thinking “Why is eBay trying to fix something that isn’t broken ?”.

The answer to this question lies in the future goals of eBay. If you take the company’s business goals into account, their previous system was in fact very “broken”. Managed payments has been posited as an attempt to fix this.

One of the clear goals is to have your transactions take place not on an external site but on the platform itself, because this improves simplicity and flexibility for buyers, sellers and eBay iteself. Most other marketplaces take on the responsibility of managing payments, even smaller platforms like depop that started out with paypal only support are slowly moving to their own integrated payments system called “depop payments”.

PayPal is a separate company from eBay and Integrating so closely with Paypal will always results in tradeoffs. Ebay finds itself outsourcing part the headache of dealing with transactions but has to sacrifice other things such as flexibility and involvement in the process. These tradeoffs are okay for some time but as new competition comes in, there is increased pressure to improve the buying experience by asserting more control.

More Options = More Conversions

Things in the online payments world are moving very fast and potential buyers will move on quickly from eBay if they did not adapt to the demands of the market.

One benefit of managed payments is that buyers on eBay have more options to pay on the site such as Apple Pay/Debit Cards/Credit Cards etc. One could speculate eventual support for “Buy now Pay later” options like Klarna/Affirm.

The bright side here for you as a seller is that more options can lead to more sales as the people who would have gone elsewhere due to a lack of support for their payment method will now be able to purchase from you. Managed payments boosts traffic on eBay as a whole which will lead to these users reaching your listings as well, you can learn more about how to increase eBay traffic here

Simplicity by consolidation

Of course simplicity is relative, paypal has been around on eBay for a long time and is “simple” by virtue of its familiarity. It is still an external service that takes you away from the eBay platform. Often times you’ll have to switch between eBay and paypal to run the day to day tasks that your business requires. Managed payments simplifies things by putting all your transaction related needs in one place.

Problems

The transition to managed payments will not be without issues, there are still problems it faces when compared to the previous system, some of which we will expand on even more later.

Longer Clearing/Processing times

A problem with eBay managed payments is that it is simply slower to get your money out. Paypal is mostly instant and you can start “using” the money in your balance to fund aspects of your business or transfer it out.

Slow processing can lead to some cashflow issues. Cash is king! afterall.

Lots of sellers actually depend on having relatively “instant access to funds” to run their businesses without assuming too much risk or taking on credit, if you are one of them then you’ll need to make some adjustments to your business plan.

Single point of failure

This is a problem caused by consolidation, before you could essentially have your funds and actual shop in separate companies but now you have them all in one place. This means if something goes wrong such as being locked out, security issues etc. since there is no clear separation, you can be limited in both your ability to run your shop and access earnings. This is of course the worst case scenario that is not unique to just eBay and unfortunately there’s no way to avoid this.

Is eBay Managed Payments Mandatory ?

If you looked over the last section on benefits/problems and still want to stick with paypal for eBay we’ve got some bad news: You can’t.

Ebay managed payments is mandatory for all sellers and the only way to avoid it is to move to a different platform. While this approach may seem drastic or laborous, it is made easier with crosslisting tools such as this that will automatically transfer your eBay listings to marketplaces. You can learn more about crosslisting here.

Ebay has made the decision to manage payments and this decision is here to stay as it is part of the future direction of the company.

eBay Managed Payments Processing Times

We discussed previously that managed payments can cause some cashflow issues because it takes longer to process your funds. An important thing to consider is how the introduction of eBay managed payments impacts how fast you will get access to the money you have made from a sale on the marketplace. A nerve wracking experience as an online seller is having your hard earned money get stuck in “limbo” when you need it.

The speed of paypal has definitely set expectations for most eBay sellers so it’s hard not to be dissapointed. A mostly instant process has been turned into a process taking several days, OUCH.

Managed payments is slower because it needs to take a bit of time to process your funds which can take a few days (at least 1 day). Once your funds are cleared you can transfer them into a bank account.

If you haven’t guessed yet, the additional issue here is that bank transfers aren’t always instant, this means that it could take even longer to receive your money. Bank transfers can take an average of 0 to 5 days depending on the:

- Method of transfer & Country: Different locations differ in the speed at which transfers are executed, some payment systems will lead you do get your money within minutes/hours while some will take days.

- Bank: Each bank also differs in the speed at which it will process your transfers.

- Day of the week: Many banks do not operate on the non business days, so if you get a sale on friday it could take longer to receive the funds from that payment. They are also subject to holidays such as bank holidays which can delay things further.

eBay Managed Payments Fees

Managed payments aims to simplifies your fee calculations by removing external payment processing costs. You will also only have to pay fees on the final value of your item (price + shipping + handling fees) of around 10% with a max fee of $750 but your fee will be impacted by a few things:

- Whether you have a store subscription: Ebay sellers with store subscriptions end up paying lower fees.

- Category of the product you are selling: Some product categories have different fees as well which could result in a higher or lower fee. Here are some of these categories below:

- Books, DVDs, Movies, and Music (except Records) = 12%, maximum fee $750

- Musical Instruments & Gear > Guitars & Basses = 3.5%, maximum fee $350

- Men > Men’s Shoes > Athletic Shoes = 0% for selling prices of $100 or more

- Women > Women’s Shoes > Athletic Shoes = 0% for selling prices of $100 or more

- Heavy Equipment Parts & Attachments > Heavy Equipment = 2%, maximum fee $300

- Printing & Graphic Arts > Commercial Printing Presses = 2%, maximum fee $300

- Restaurant & Food Service > Food Trucks, Trailers & Carts = 2%, maximum fee $300.

- Marketplace Region: There may be variations in the fees for different eBay regions for example eBay UK vs eBay AU vs eBay IT vs eBay FR.

You can use our ebay fee calculator to quickly figure out what your fees on the marketplace will be.